Sage 100 Contractor 5-2-1 Employees

Overview:

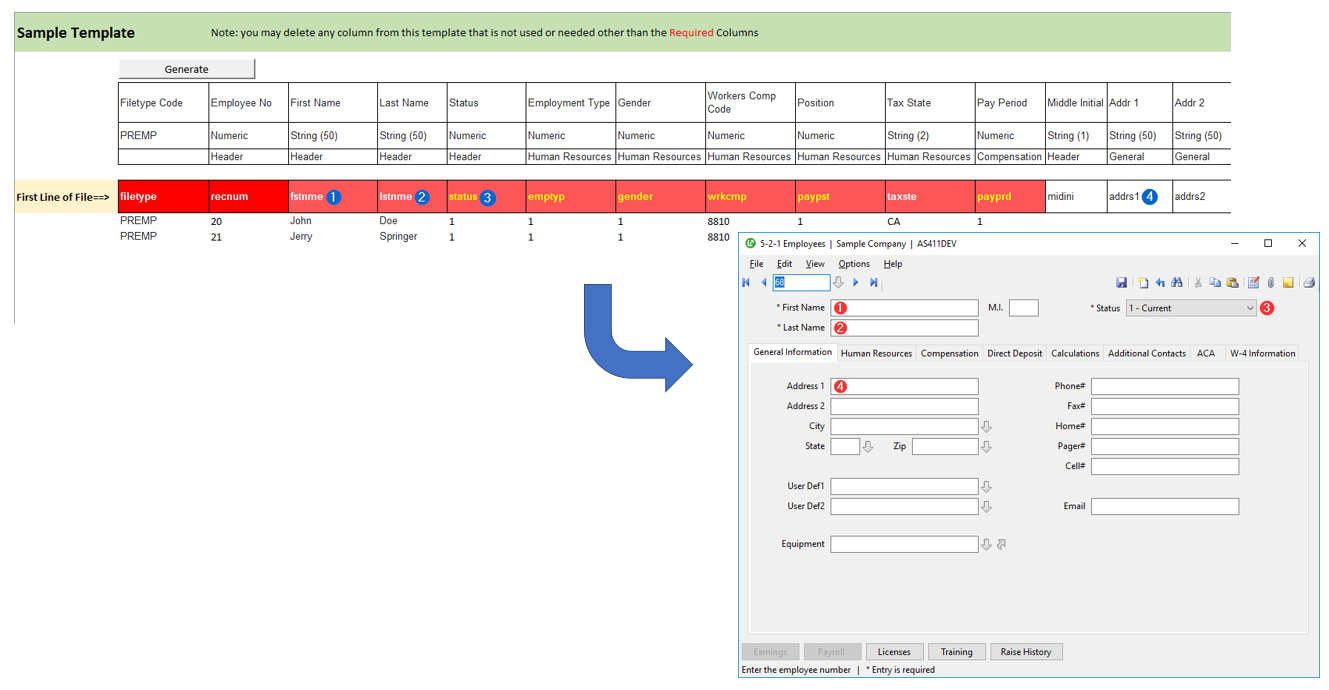

Import Employees into Sage 100 Contractor. Simply download your employees into Excel, review and apply employee information and import directly into Sage 100 Contractor 5-2-1 Employees.

Are you tired of manually keying in Employees one by one into Sage 100 Contractor? Would you rather download your employees, fill in the blanks in Excel and import the details directly into Sage 100 Contractor? The following integration template allows you to do just that. It mimics every feature and function of the 5-2-1 Employees data entry form.

Key Features:

- Download Employees into Excel

- Edit key employee information in Excel

- Bulk import employees directly into Sage 100 Contractor

- Supports all native features and functions of the 5-2-1 Employees Entry Form

Import Template Download:

Import File Layout:

| Header | Reference | Data Type | Tab | Example | Description |

| filetype | Required | PREMP | PREMP | (File Type Code) | |

| recnum | Required | Numeric | Header | Employee No | |

| fstnme | Required(I) | String (50) | Header | First Name | |

| lstnme | Required(I) | String (50) | Header | Last Name | |

| status | Required(I) ** | Numeric | Header | 1=Current; 2=On leave; 3=Quit; 4=Laid off; 5=Terminated; 6=On probation; 7=Deceased; 8=Retired | Status |

| emptyp | Required(I) ** | Numeric | Human Resources | 1=Reg full-time; 2=Reg part-time; 3=Temp full-time; 4=Temp part-time | Employment Type |

| gender | Required(I) ** | Numeric | Human Resources | 1=Male;2=Female;3=Nonbinary | Gender |

| wrkcmp | Required(I) ** | Numeric | Human Resources | Workers Comp Code | |

| paypst | Required(I) ** | Numeric | Human Resources | Position | |

| taxste | Required(I) ** | String (2) | Human Resources | CA | Tax State |

| payprd | Required(I) ** | Numeric | Compensation | 1=Weekly; 2=Bi-weekly; 3=Semi-monthly; 4=Monthly; 5=Quarterly; 6=Semi-annual; 7=Annual | Pay Period |

| ncknme | String (50) | Header | Nickname | ||

| midini | String (1) | Header | Middle Initial | ||

| admacs | Numeric | 1=yes;0=No | Require Payroll Admin Access | ||

| addrs1 | String (50) | General | Addr 1 | ||

| addrs2 | String (50) | General | Addr 2 | ||

| ctynme | String (50) | General | City | ||

| state_ | String (2) | General | State | ||

| zipcde | String (10) | General | Zip | ||

| phnnum | String (14) | General | Phone No | ||

| pagnum | String (14) | General | Pager No | ||

| faxnum | String (14) | General | Fax No | ||

| cllphn | String (14) | General | Cell No | ||

| homnum | String (14) | General | Home No | ||

| e_mail | String (75) | General | |||

| usrdf1 | String (50) | General | User Def 1 | ||

| usrdf2 | String (50) | General | User Def 2 | ||

| eqpnum | ** | Numeric | General | Equipment | |

| mrtsts | ** | Numeric | Human Resources | 0=Unassigned; 1=Single; 2=Married; 3=Single with dependents; 4=Married with dependents | Benefit Status |

| hertge | ** | Numeric | Human Resources | 0=Decline to state; 1=White (not Hispanic/Latino); 2=Black/African American; 3=Hispanic/Latino (any race); 4=Asian; 5=American Indian/Alaska Native; 6=Native hawaiian/Pacific Islander; 7=Two or more races | Heritage |

| empcmp | Numeric | Human Resources | 1=yes;0=No | Always use employee comp code | |

| uninum | ** | Numeric | Human Resources | Union | |

| loctax | ** | Numeric | Human Resources | Residence Locale Tax | |

| locwrk | ** | Numeric | Human Resources | Work Locale Tax | |

| soccde | ** | Numeric | Human Resources | Standard Occupation Classification code | |

| socsec | String (44) | Human Resources | [Encrypted Field] | Social Security *** | |

| dtebth | Date | Human Resources | yyyy-mm-dd | Birth Date | |

| dtehre | Date | Human Resources | yyyy-mm-dd | Hire Date | |

| dteina | Date | Human Resources | yyyy-mm-dd | Inactive Date | |

| lstrse | Date | Human Resources | yyyy-mm-dd | Last Raise | |

| i9verf | ** | Numeric | Human Resources | 1=yes;0=No | I-9 verified |

| crtrpt | ** | Numeric | Human Resources | 1=yes;0=No | Exempt from certified reporting |

| exmovr | ** | Numeric | Human Resources | 1=yes;0=No | Exempt from overtime pay |

| hiract | ** | Numeric | Human Resources | 1=yes;0=No | Eligible under HIRE Act of 2010 |

| eeoprx | ** | Numeric | Human Resources | 1=yes;0=No | Use proxy hours for EEO-1 reporting |

| paycls | ** | Numeric | Compensation | 0=Unassigned; 1=Hourly; 2=Shift; 3=Day; 4=Week; 5=Salary; 6=Piece; 7=Commission | Pay Classification |

| paygrp | ** | Numeric | Compensation | Paygroup | |

| payrt1 | Numeric (6,4) | Compensation | Regular Hourly Rate | ||

| payrt2 | Numeric (6,4) | Compensation | Overtime Hourly Rate | ||

| payrt3 | Numeric (6,4) | Compensation | Premium Hourly Rate | ||

| salary | Numeric (10,2) | Compensation | Salary | ||

| comisn | Numeric (3,0) | Compensation | Commission % | ||

| advdue | Numeric (10,2) | Compensation | Advanced Due | ||

| accsck | Numeric (4,2) | Compensation | Sick Accrued | ||

| sckrte | Numeric (5,5) | Compensation | Sick Accrual Rate | ||

| sckmth | ** | Numeric | Compensation | 1-Per period; 2-Per hour | Sick Accrual Method |

| sckmax | Numeric (4,2) | Compensation | Sick Accrual Max | ||

| sckbeg | Numeric (10,0) | Compensation | Sick Last Yr Carry Forward | ||

| accvac | Numeric (4,2) | Compensation | Vacation Accrued | ||

| vacrte | Numeric (5,5) | Compensation | Vacation Accrual Rate | ||

| vacmth | ** | Numeric | Compensation | 1-Per period; 2-Per hour | Vacation Accrual Method |

| vacmax | Numeric (4,2) | Compensation | Vacation Accrual Max | ||

| vacbeg | Numeric (4,2) | Compensation | Vacation Last Yr Carry Forward | ||

| retchk | Numeric | Compensation | 1=yes;0=No | Retirement Plan | |

| sckchk | Numeric | Compensation | 1=yes;0=No | Third-Party Sick Pay | |

| w_2elc | Numeric | Compensation | 1=yes;0=No | Consent for Electronic W-2 | |

| dirdep | Numeric | Direct Deposit | 1=yes;0=No | Enable Direct Deposit | |

| prente | ** | Numeric | Direct Deposit | 0=None;1=Prenote;2=10 day wait;3=Active;4=Inactive | Dir Dep - Status 1 |

| acttyp | ** | Numeric | Direct Deposit | 1=Checking;2=Savings | Dir Dep - Acct Type 1 |

| rtnmbr | String (9) | Direct Deposit | Dir Dep - Route No 1 | ||

| actnum | String (64) | Direct Deposit | Dir Dep - Acct No 1 | ||

| rtetyp | ** | Numeric | Direct Deposit | 0=None; 1=Dollar amount; 2=Percent of net pay; 3=Remainder of check | Dir Dep - Rate Type 1 |

| depamt | Numeric (3,0) | Direct Deposit | Dir Dep - Amount 1 | ||

| prent2 | ** | Numeric | Direct Deposit | 0=None; 1=Prenote; 2=10 day wait; 3=Active; 4=Inactive | Dir Dep - Status 2 |

| acttp2 | ** | Numeric | Direct Deposit | 1=Checking;2=Savings | Dir Dep - Acct Type 2 |

| rtnmb2 | String (9) | Direct Deposit | Dir Dep - Route No 2 | ||

| actnm2 | String (64) | Direct Deposit | Dir Dep - Acct No 2 | ||

| rtetp2 | ** | Numeric | Direct Deposit | 0=None; 1=Dollar amount; 2=Percent of net pay; 3=Remainder of check | Dir Dep - Rate Type 2 |

| dp2amt | Numeric (3,0) | Direct Deposit | Dir Dep - Amount 2 | ||

| prent3 | ** | Numeric | Direct Deposit | 0=None; 1=Prenote; 2=10 day wait; 3=Active; 4=Inactive | Dir Dep - Status 3 |

| acttp3 | ** | Numeric | Direct Deposit | 1=Checking;2=Savings | Dir Dep - Acct Type 3 |

| rtnmb3 | String (9) | Direct Deposit | Dir Dep - Route No 3 | ||

| actnm3 | String (64) | Direct Deposit | Dir Dep - Acct No 3 | ||

| rtetp3 | ** | Numeric | Direct Deposit | 0=None; 1=Dollar amount; 2=Percent of net pay; 3=Remainder of check | Dir Dep - Rate Type 3 |

| dp3amt | Numeric (3,0) | Direct Deposit | Dir Dep - Amount 3 | ||

| prent4 | ** | Numeric | Direct Deposit | 0=None; 1=Prenote; 2=10 day wait; 3=Active; 4=Inactive | Dir Dep - Status 4 |

| acttp4 | ** | Numeric | Direct Deposit | 1=Checking;2=Savings | Dir Dep - Acct Type 4 |

| rtnmb4 | String (9) | Direct Deposit | Dir Dep - Route No 4 | ||

| actnm4 | String (64) | Direct Deposit | Dir Dep - Acct No 4 | ||

| rtetp4 | ** | Numeric | Direct Deposit | 0=None; 1=Dollar amount; 2=Percent of net pay; 3=Remainder of check | Dir Dep - Rate Type 4 |

| dp4amt | Numeric (3,0) | Direct Deposit | Dir Dep - Amount 4 | ||

| pyreml | String (75) | Direct Deposit | Direct Deposit Email | ||

| w4_1_c | ** | Numeric | W-4 Information | 0-Not set up; 1-Single or Married Filing separately; 2-Married filing jointly (or Qualifying widow(er)); 3-Head of household | W-4 - Step 1 Personal Information |

| w4_2_c | ** | Numeric | W-4 Information | 1=yes;0=No | W-4 - Step 2 Multiple Jobs or Spouse Works |

| w4_3__ | Numeric (10,2) | W-4 Information | W-4 - Step 3 Claim Dependants Total Amount | ||

| w4_4_a | Numeric (10,2) | W-4 Information | W-4 - Step 4(a) - Other Income | ||

| w4_4_b | Numeric (10,2) | W-4 Information | W-4 - Step 4(b) - Deductions | ||

| w4_4_c | Numeric (10,2) | W-4 Information | W-4 - Step 4(c) - Extra Witholding | ||

| w4_dte | Date | W-4 Information | yyyy-mm-dd | W-4 - Step 5 - Date Signed | |

| ntetxt | Text | Header | Notes |

Required(I) - required when the action type selected is insert or insert and update

** Validated Field - value is either restricted to a defined list of values or exists in the fields respective lookup table in Sage 100 Contractor

*** Field Encryption - this field is encrypted by default, in order to import a value into this field, Encryption must be turned OFF

1) Go To 7-1 Company Information

2) Click Options, then Database Security Encryption

3) Select "OFF"

File Example:

filetype,recnum,fstnme,lstnme,status,emptyp,gender,wrkcmp,paypst,taxste,payprd

EMP,2001,"Harold","Jones",1,1,1,5606,2,CA,2

EMP,2002,"Stacey","McCory",1,1,1,5606,2,CA,2